how to lower property taxes in nj

Give power back to the people of New Jersey. Here are five interventions to cut spending and reduce property taxes.

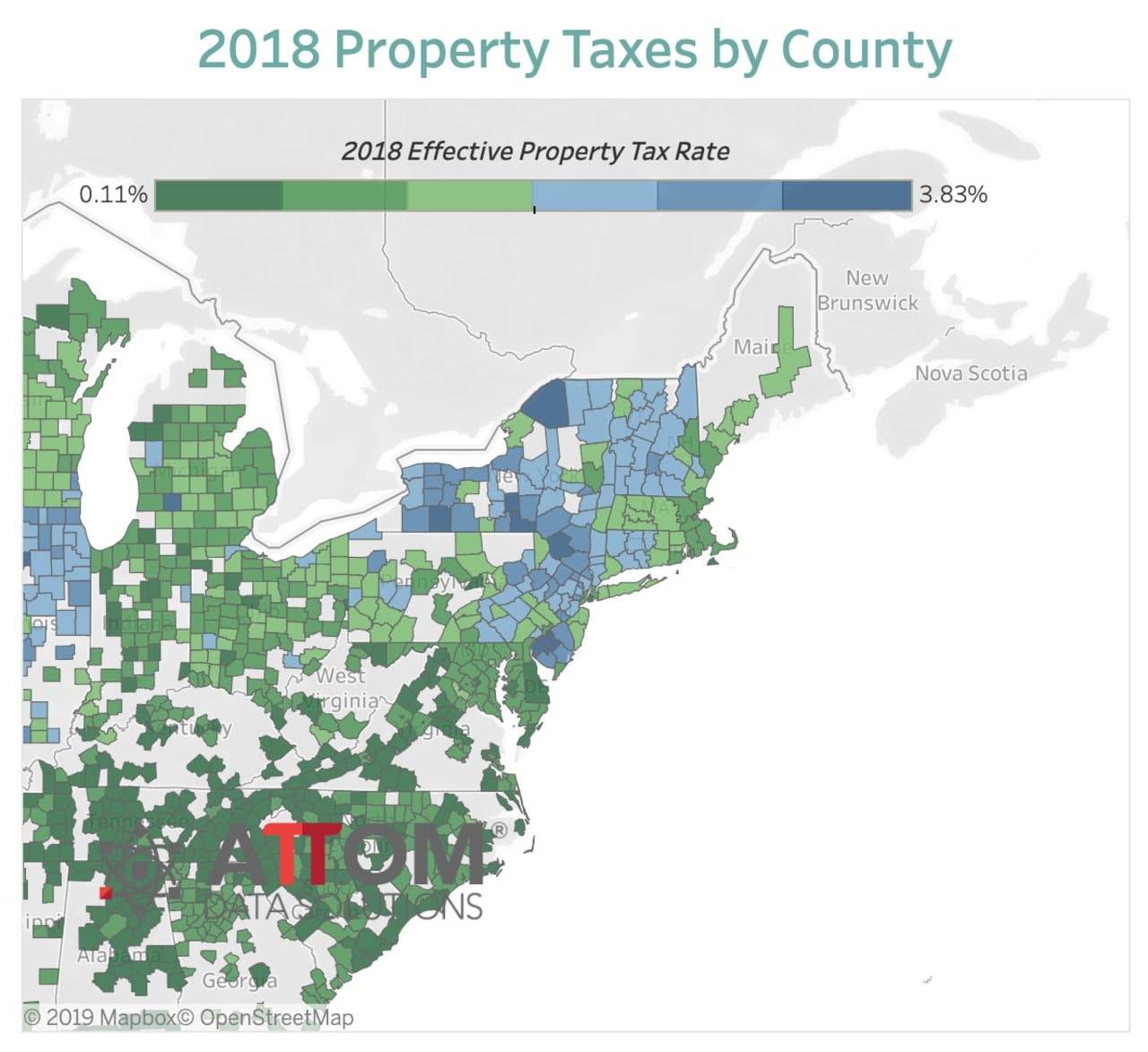

Property Tax Comparison By State For Cross State Businesses

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

. NJs veteran property tax deduction is one way you can lower property taxesVeteran properties are exempt from federal property taxesMake sure you are a homeownerBe a legal resident of New Jersey for lifeExperience military service in the USHonorable discharge from the armed forces. On the towns website we quickly found the link to enter an online appeal with the countys board of taxation. Find the three tax ratios for your city.

See If You Qualify For Tax Exemptions. Active military service property tax deferment. Those include property taxes on lands dedicated to cemetery purposes income taxes sales and use taxes business.

According to the Garden States tax code cemetery companies any entity that owns operates controls or manages land or places used for the burial of human remains is exempt from many forms of taxation. Perhaps State workers should get a benefit discount on property taxes. Hunterdon County collects the highest property tax in New Jersey levying an average of 852300 191 of median home value yearly in property taxes while Cumberland County has the lowest property tax in the state collecting an average tax of 374400 213 of median.

The exact property tax levied depends on the county in New Jersey the property is located in. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. 250 property tax deduction for senior citizens and disabled persons.

State salaries do not support the extremely high NJ property taxes. If you want to receive a veteran property tax deduction you need to. How Much Property Tax Can I Deduct In Nj.

Most people call it a tax appeal. Participate During Your Assessors Walkthrough. Filing the appeal.

Research Neighboring Home Values. An average of 700 can be claimed by homeowners earning 250000 or more each year bringing the effective rate. Other Neat Methods To Lower Property Taxes in NJ Skip all home improvement projects Make sure that your tax bill has no errors Appeal your property tax bill with DoNotPay Keep the assessors company while they do their job Apply for the applicable property tax exemptions.

Click on your county. Start taxing food and clothing and apply that revenue to the schools which in turn should lower property taxes. New Jersey voters tried unsuccessfully in 1981 in 1983 and again in 1986 to.

Here are the programs that can help you lower property taxes in NJ. How Can New Jersey Lower Property Taxes. If these three ratios are not between 0 and 1 then divide them by 100.

Approximately 8 million residents will live in the state in fiscal year 2023. Check Your Tax Bill For. Go to the New Jersey Division of Taxation website through the link in the References section.

NJ Veterans Property Tax Exemption. If you were in the program prior to the move and received a reimbursement for the last full tax year you occupied your previous home you may qualify for the 2-year exception. As a deduction you can deduct your property taxes if you paid less than 15000 or more if your tax was paidAn individual may deduct 10000 for Tax Years 2017 and earlierIn case a tenant pays rent during the year 18 is included in their property taxes.

How Can You Lower Your Property Taxes In Nj. In order to come up with your tax bill your tax office multiplies the tax rate by the. 100 disabled veteran property tax exemption.

A New Jersey real estate property owner and sometimes a tenant has the legal right to attempt to reduce their real estate taxes through the process known as a real property tax assessment appeal. For example if your tax ratios are 2486 2925 and 3364 then divide them by 100 to get 2486 2925 and 3364 Now they are between. It allowed us to create a login and enter the evidence including.

Call the Senior Freeze Information Line at 1-800-882-6597 for more information. Your local tax collectors office sends you your property tax bill which is based on this assessment. Limit Home Improvement Projects.

How To Lower Property Taxes. It was announced earlier today that Murphy will propose 1 trillion dollars in relief to the taxation of property. 250 veteran property tax deduction.

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Property Tax Appeal Tips To Reduce Your Property Tax Bill

The Official Website Of City Of Union City Nj Tax Department

This Isn T First The Time Christie Has Vowed To Lower Our Taxes Vows Christy Paterson

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Property Tax How To Calculate Local Considerations

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

How School Funding S Reliance On Property Taxes Fails Children Npr

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

These Hudson Valley Counties Have Highest Property Tax Rates In Nation New Study Says Ramapo Daily Voice

Property Taxes By State Embrace Higher Property Taxes

2022 Property Taxes By State Report Propertyshark

N J Now Has 2b In Property Tax Relief What You Need To Know And How To Get Your Rebates Nj Com

Nj Property Tax Relief Program Updates Access Wealth

Property Taxes Property Tax Analysis Tax Foundation

Tips For Selling Your Home In Wyckoff New Jersey Homes For Sale In Bergen County Nj Luxury Real Estate Wyckoff Homes F Estates Real Estate Nj Real Estate

Deducting Property Taxes H R Block